In this Blog post you are gonna know all about “What is a bear market in stock market”.

A bear market is the inevitable downturn in the stock market cycle, creating panic among investors. However, they are temporary and may present investment opportunities. Understanding the impact of a bear market is critical to protecting investment portfolios during economic challenges. These include bearish trends, characteristics of bear markets, reasons for current market declines, and strategies for navigating volatile times.

IMPORTANT HIGHLIGHTS

- A bear market is characterized by a significant decline in stock prices, usually exceeding 20% from the most recent high.

- Bear markets often change investor sentiment from optimism to pessimism. During bearish periods, investors become more risk-averse and may sell their holdings to avoid further losses.

- Bear markets can have significant economic consequences, including reduced consumer spending, reduced business investment, and increased unemployment. Falling stock prices can undermine consumer and investor confidence, leading to a contraction in economic activity and potentially triggering a recession.

Contents

What Is A Bear Market In Stock Market?

A bear market occurs when stock prices decline continuously over an extended period of time. This downward trend is characterized as bearish when the price drops by at least 20% and investor sentiment turns negative. Such markets can last for months or even years and coincide with economic downturns such as recessions.

Not only do aggregate market indices such as the S&P 500 fall, but individual securities or products can also be considered a bear market if they fall 20% or more over a sustained period of time – usually lasting two months or more. Despite the overall disappointment, some investors see an opportunity to buy stocks at lower prices in hopes of an eventual recovery if market sentiment turns bullish again.

What to Do When the Stock Market Crashes

History of Bear Market in Stock Market

History of Bear Markets in Stock Markets:

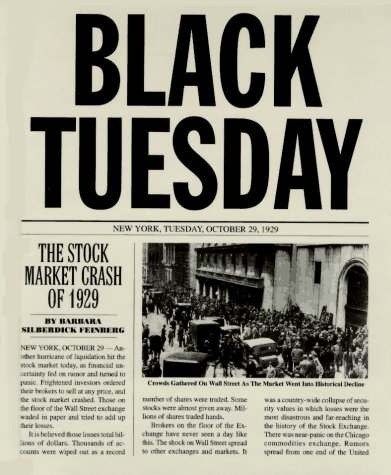

: The Great Depression of 1929 :

Considered one of the longest depressions in modern history, the Great Depression was triggered by a bearish market trend that continued for nearly a decade. Prior to 1929, rampant speculation induced individuals to purchase over-inflated assets at prices higher than their true value. This speculative growth leads to excess production and supply in the market, leading to a significant fall in the average price level, leading to inflation which also affects the stock market. The stock market crash of 1929, known as the Black Tuesday, marked the beginning of the Great Depression.

: Oil crisis and stagnation (1973-1974) :

The oil crisis of 1973, geopolitical tensions in the Middle East caused oil prices to rise sharply, and a combination of stagnant economic growth and high inflation led to stagnation. This economic instability contributed to bear markets in many countries, including the United States and India. Stock prices declined significantly during this period, reflecting broader economic challenges.

: Asian Financial Crisis (1997-1998) :

The Asian financial crisis, caused by currency devaluation and financial instability in Southeast Asian countries such as Thailand, Indonesia, South Korea, and Malaysia, had an impact on global financial markets. The stock markets of the affected countries experienced sharp declines and investor confidence declined. The crisis spread to other regions, including India, where share prices fell sharply, contributing to a bearish market sentiment.

: The dot-com bubble burst (2000-2002) :

The turn of the millennium witnessed the bursting of the dot-com bubble, which was marked by the collapse of many Internet-based companies that had seen inflated valuations in the late 1990s. Investors poured huge sums of money into these companies hoping for rapid growth and profits. However, when many of these companies fail to deliver on their promises, stock prices fall, leading to a bullish market. This period of decline lasted from 2000 to 2002, with significant losses in major stock indices.

: 2008 Recession :

The global financial crisis of 2008, often referred to as the 2008 recession, stemmed from the subprime mortgage crisis in the United States and the subsequent collapse of Lehman Brothers Holdings Inc., one of the world’s largest financial institutions. The impact of this economic slowdown was felt globally, including in India, where the Sensex fell by 1408 points on January 31, 2008. Indian investors adopted a bearish investment approach during this period, preferring to hold their money or make risk-free investments. machine

[These historical events illustrate how factors such as speculative bubbles, financial crises, geopolitical tensions, and economic imbalances can lead to bull markets in the stock market, highlight the cyclical nature of market downturns, and highlight the importance of understanding historical precedent for informed investment decision-making.]

Understanding Of Bear Market

Title: Navigating Bear Markets: Understanding, Strategy and Insights

Recognize a bear market:

A bear market is characterized by a sustained decline in stock prices, usually exceeding 20% over at least 60 days. This decline reflects investor desperation and a shift towards safer investment options, indicating an economic slowdown or recession. Key indicators include declining stock market indices and recessionary trends characterized by low demand and negative GDP growth.

Reasons for a bear market:

A variety of factors can trigger a bear market, including a weak or sluggish economy, bursting of market bubbles, geopolitical crises, and paradigm shifts such as the transition to the online economy. Additionally, government intervention, changes in tax rates, or changes in investor confidence can contribute to market downturns.

Weak or Slow Economy:

Bear markets are often associated with economic recessions or contractions, characterized by low employment, poor productivity and declining business profits. Factors such as reduced consumer spending, reduced investment activity and stagnant economic growth can contribute to investor pessimism and market downturns.

Bursting of market bubbles:

Speculative bubbles in asset markets, such as real estate or technology stocks, can lead to volatile price increases followed by sharp corrections. When these bubbles burst, it can cause widespread panic among investors and trigger bear markets. The bursting of the housing bubble in 2008, for example, precipitated a global financial crisis and subsequent bear market.

Geopolitical Crisis:

Geopolitical tensions, conflicts, or crises can affect investor sentiment and trigger bullish markets. Events such as war, trade disputes or political unrest can create uncertainty and volatility in financial markets, leading investors to adopt a risk-averse stance and sell their holdings.

Paradigm changes in the economy:

Structural changes in the economy, such as technological disruption or changes in consumer preferences, can also contribute to market drift. For example, the transition to an online economy or the emergence of new industries may disrupt existing business models and lead to market corrections as investors reevaluate their investment strategies.

Types of Bear Markets:

Bear markets can be categorized into secular and cyclical trends. Secular bear markets arise from long-term economic conditions, often influenced by domestic policy, while cyclical bear markets result from business cycle fluctuations, which last for a short period of time.

Cyclical Bear Markets:

Cyclical bear markets are shorter in duration, usually lasting from a few weeks to a few months. These market downturns are often associated with business cycle fluctuations, such as economic contractions or recessions. For example, the global economic downturn caused by the subprime mortgage crisis in 2008 resulted in a cyclical bear market, characterized by sharp declines in stock prices over a relatively short period of time.

Bear Market Consequences:

Bear markets bring economic downturns, growing investor pessimism, and bearish tendencies. Businesses face challenges as investment declines and consumer demand falls, leading to high unemployment and inflationary pressures.

Investment Strategies for Bear Markets:

Navigating a bear market requires strategic planning and adaptability. Investors can restructure their investments, focus on defensive stocks, implement dollar-cost averaging, diversify their portfolios, keep cash reserves, and carefully select stocks that are resilient to economic downturns.

Restructuring investments:

Instead of panic-selling during bear markets, investors can consider reallocating their portfolios to safer assets or defensive sectors. This may involve reducing exposure to volatile stocks and increasing holdings in assets such as bonds, cash equivalents, or defensive stocks with stable income and dividends.

Dollar-Cost Averaging:

Dollar-cost averaging involves investing a fixed amount of money at regular intervals regardless of market conditions. This strategy can help investors reduce the impact of market volatility by spreading their investments over time and buying more shares when prices are lower. In the long run, dollar-cost averaging can result in lower average costs per share and potentially higher returns.

Portfolio Diversification:

Diversifying your investment portfolio across different asset classes, sectors and geographies can help reduce overall risk and reduce the impact of bear markets. By spreading investments across a range of assets, investors can minimize the impact of market downturns on their overall portfolio performance.

Defensive Investments:

Defensive investments involve focusing on companies or sectors that are less vulnerable to economic downturns and market volatility. This can include investing in stable, established companies with strong balance sheets, consistent earnings and reliable dividends. Defensive sectors such as healthcare, utilities, and consumer staples perform relatively well during bear markets due to their defensive nature.

Proactive risk management:

During bear markets, it is imperative for investors to proactively manage risk and closely monitor their portfolio. This may involve setting stop-loss orders to limit potential losses, hedging against downside risk with options or futures contracts, or implementing dynamic asset allocation strategies to adjust portfolio exposure based on market conditions.

Long-term perspective:

Finally, it is important for investors to maintain a long-term perspective and avoid making emotional decisions based on short-term market fluctuations. Bear markets can be challenging, but history shows that markets eventually recover and reward patient, disciplined investors who stay. By focusing on long-term investment goals and staying diversified, investors can confidently navigate better markets and ultimately emerge stronger.

Recent examples and key insights:

Recent bear markets, such as the 2008 financial crisis and the 2020 Covid-19 pandemic, highlight the volatility and unpredictability of the stock market. Understanding market dynamics, staying abreast of economic indicators and maintaining a long-term investment perspective are crucial to successfully navigating bear markets.

Here’s The Best Online Brokers for your investment journey:-

[ Do not influence by our recommendation. It’s entirely your responsibility to find the best broker ]

Conclusion:

In conclusion, bear markets are an inevitable component of the stock market cycle, presenting both challenges and opportunities for investors. By understanding the signs, causes, and consequences of bear markets and implementing effective investment strategies, investors can navigate volatile times and emerge stronger over the long term. Remember, staying informed, being patient, and focusing on long-term goals are key to weathering a bear market storm.

3 thoughts on “What Is A Bear Market In Stock Market- For Beginners 2024”