In today’s blog post we are gonna discuss all about “Short Put Option Strategy -For Beginners”.

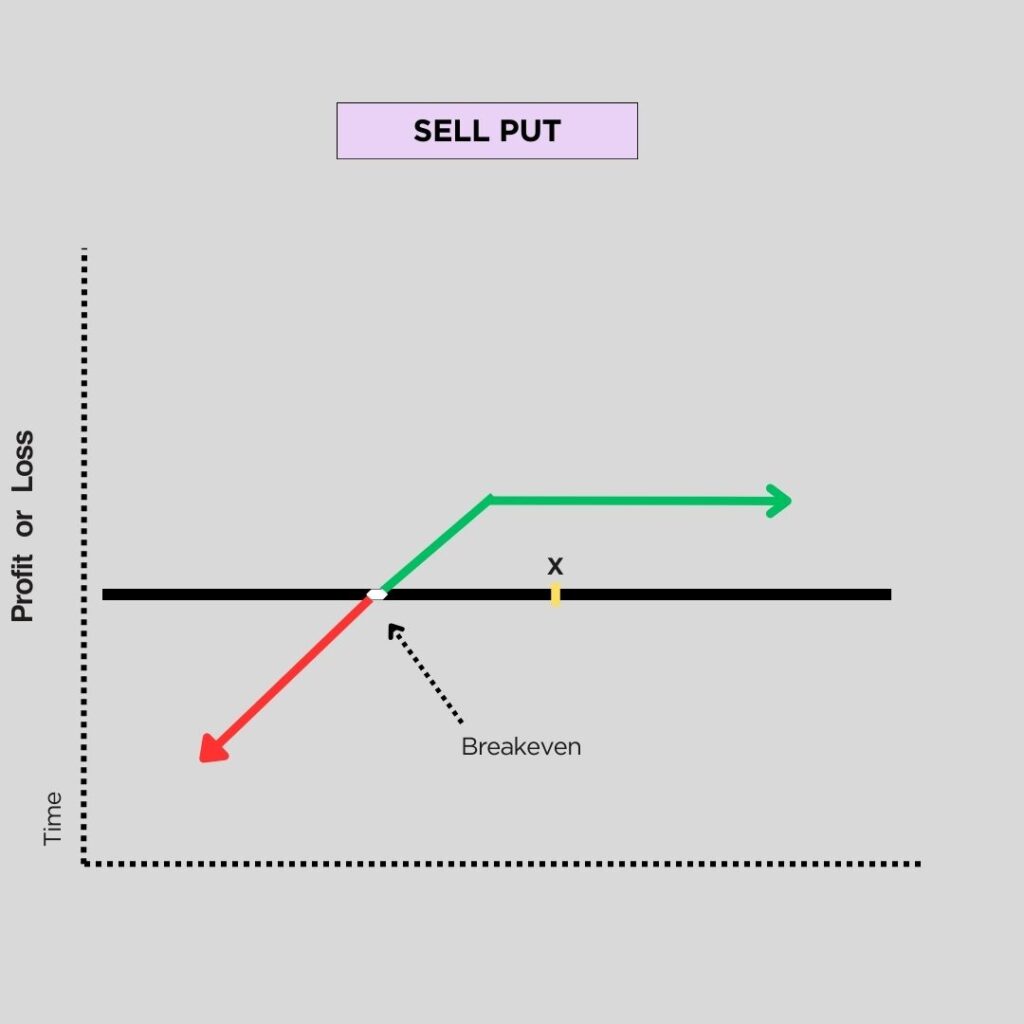

When you use short put you are essentially making a bet that the stock price will rise this time. People usually buy puts when they expect the stock price to go down, but on a seller’s side you believe it will go up. You get paid in advance to make this bet. However, you must be careful playing this bet, as there is a lot of risk involved. If things get really bad, and the market starts going down instead of up, you can lose a lot. So to play it safe some traders use techniques like spreads. Simple short put means “I think the stock will go up”.

Table of Contents

How Short Put Option Strategy Work

When you a short put option, it’s like making a contract to buy a stock at a certain price. If the stock goes down, you can lose money because you have to buy it at that price but can only sell it at a lower price. But if the stock goes up, you make money from the fee the buyer paid you.

People who short puts usually pick stocks that they think will go up. They hope that the money they make from fees will cover the times they lose money when the stock goes down. If things don’t look good, they can get out of the deal by buying the same option from someone else, but they try to pay less.

Some people sell stocks that they believe are a good deal. They are happy to buy at the current price, and discount the fee from the buyer.

There are two main ways to do this: keep enough money to cover the stock purchase or use margin, which is somewhat risky.

If you sell a put, you promise to buy the stock if the buyer wants to sell it. You expect the stock to stay the same or go up. If the stock falls below the price you agreed upon, you must buy it. But if it stays the same or goes up, you keep the fee and you can do it again to make more money.

Example of Nifty, Bank Nifty & U.S Stock

let’s walk through a simple example of the “sell put” option strategy for both Nifty and Bank Nifty in the Indian stock market and an American stock in the U.S. market.

Nifty (Indian Stock Market)

Let’s say the current Nifty index is at 25,000, and you believe it won’t fall below 24,500. You decide to sell a put option with a strike price of 24,500 that expires in one month. For this, you receive a premium of ₹200.

If, by the expiration date, Nifty remains at 25,000 or goes higher, the option expires “out of the money,” and you keep the ₹200 premium as your profit. However, if Nifty falls below 24,500, the option becomes “in the money,” and you may have to buy Nifty at 24,500, even if its market value is lower. Your profit will be reduced by the difference between the strike price and the actual market price.

Bank Nifty (Indian Stock Market)

Similarly, let’s consider Bank Nifty. If the current index is 45,000, and you’re confident it won’t drop below 44,000, you sell a put option with a strike price of 44,000, receiving a premium of ₹150. The same principles apply: profit if Bank Nifty stays the same or goes up, potential obligation to buy if it falls below the strike price.

American Stock Market

Now, let’s switch to the American stock market. Suppose you are interested in a U.S. stock, let’s call it XYZ Inc., which is currently priced at $50 per share. You sell a put option with a strike price of $45, expiring in one month, and receive a premium of $2.

If the stock stays at $50 or goes up, the option expires “out of the money,” and you keep the $2 premium. If the stock drops below $45, the option becomes “in the money,” and you might have to buy the stock at $45, even if its market value is lower, impacting your profit accordingly.

In both cases, the key is predicting the market movement and choosing strike prices that align with your expectations. Always be aware of the risks involved and the potential for market fluctuations.

[ If you want to build your strategy than you may use- Sensibull ]

Conclusion

If the market outlook is bullish, the choice between buying a call option and short put option depends on the attractiveness of the premium. Opting to buy a call is wise if the call option premium is low, whereas selling a put becomes attractive when the put option carries a high premium. The decision depends on evaluating the attractiveness of these premiums and a deep understanding of option value is essential to make an informed choice. As we determine option pricing in the upcoming modules, we will acquire the necessary background knowledge.

2 thoughts on “Short Put Option Strategy- For Beginners 2024”