Welcome to insightstockology.com. In this blog post we are discuss about “Bull Call Spread Option Strategy- For Beginners 2024“.

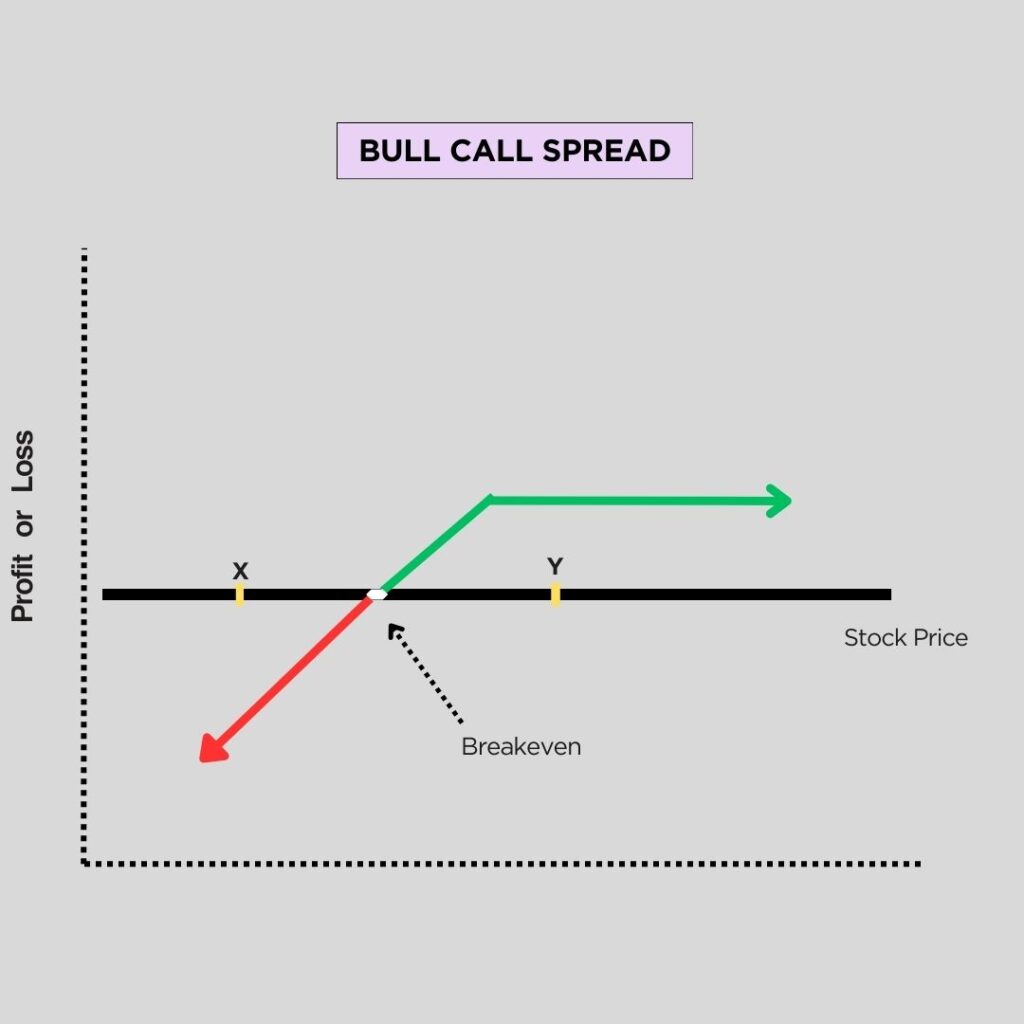

A bull call spread is an option trading strategy involving two call options. This strategy is used when expecting a moderate increase in the price of the underlying asset. This involves buying an in-the-money call option and simultaneously selling an out-of-the-money call option with the same expiration date. The goal is to profit from a controlled cost by using premiums from calls sold to offset the cost of calls purchased. This strategy is suitable in an upward trending market.

Important Highlights

- A bull call spread allows traders to take a bullish stance on an underlying asset while limiting their potential loss.

- The strategy involves selling a call option to offset the cost of buying another, thereby reducing the upfront investment.

- The maximum profit of a bull call spread is limited, when the price of the underlying asset exceeds the higher strike price.

Contents-

Overview for Bull Call Spread Option Strategy

- Resource Selection:

- Identify resources expected to grow.

- Purchase of call options:

- Buy a call option (ITM) on a selected asset, giving the right to buy at a set price before expiration.

- Call Option Sale:

-Sell a call option (OTM) for the same asset and expiration at the same time, at a higher strike price, receiving a premium. - Position Monitoring:

- Monitor alternative values, underlying asset prices and overall market conditions for asset price appreciation.

- Position Closure:

- Decide near expiration whether to exercise the options or close the position. Maximum profit occurs if the put call option is worthless and the price of the underlying asset is above its strike price.

- Limitation of Profits and Losses:

- The maximum profit is the difference between the strike price, less the net premium paid. The maximum loss is limited to the net premium paid to establish the spread.

Traders start by picking an asset that they expect to grow. They then buy a call option on that asset, gaining the right to buy it at a specified price before expiration. Simultaneously, they sell a call option for the same asset, expiring at the same time but at a higher strike price. The goal is to increase the value of the asset, allowing profit from purchased call options.

Example

In a bull call spread, a trader expects a stock to rise moderately. They buy a call at the current price ($50) and sell a higher strike call ($55) to reduce the cost. The value of the spread at expiration is the difference between the value of the underlying asset (St) and the low strike price (XL), minus the difference between St and the high strike price (XH). This strategy aims to profit from the upward movement of stocks while managing costs.

A 55-65 call spread with costs of $2.50 involves buying $55 calls and selling $65 calls. The $10 strike width is the potential profit, but deducting the paid premium ($2.50) results in a maximum profit of $7.50. As time decay affects profitability, timing is needed with in-the-money spreads and out-of-the-money spreads benefit from ending trades sooner.

Let’s consider a hypothetical scenario involving a bull call spread on Nifty 50.

Suppose Nifty’s current value is at 21,000, and the trader expects a moderate rise in its price in the coming months. The trader decides to execute a bull call spread:

- Buy Call Option on Nifty:

- Buy an at-the-money call option with a strike price of 21,000 for Nifty, expiring in one month.

- Assume the premium for this option is $150 per Nifty index unit.

- Sell Call Option on Nifty:

- Simultaneously, sell an out-of-the-money call option for Nifty with a strike price of 22,000, expiring in one month.

- The premium received for selling this option is $50 per Nifty index unit.

Now, let’s break down the possible outcomes:

- Maximum gain:

- The maximum profit is determined by the difference in the strike price minus the net premium paid or received.

- In this case, it will be (22,000 – 21,000) – ($150 – $50) = $900 per Nifty index unit.

- Maximum damage:

- Maximum loss is limited to the net premium paid to set up the spread.

- In this example, it would be $100 per Nifty index unit ($150 premium paid for at-the-money calls minus $50 premium for received-out-of-the-money calls).

- Even point break:

- The break-even point is reached when the combined premiums paid and equal to the difference in strike prices.

- Here, break-even point is (21,000 + $100) = 21,100 for Nifty.

This bull call spread strategy allows the trader to profit from moderate rises in Nifty while controlling costs and determining both maximum profit and maximum loss.

Let’s consider a hypothetical scenario involving Bank Nifty:

which is currently trading at 45,000 points. An investor, let’s call him Rakesh, is anticipating a moderate upward movement in Bank Nifty next month. To capitalize on this expectation, Rakesh decides to implement a bull call spread option strategy.

First, Rakesh buys an at-the-money call option with a strike price of 45,000 for a premium of, say, $300 per contract. Simultaneously, Rakesh sells an out-of-the-money call option with a strike price of 46,000 for a premium of $150 per contract.

Now, let’s break down the possible outcomes:

- Maximum profit:

- The maximum profit for this bull call spread is the difference between the high and low strike price minus the net premium.

- In this case, it would be (46,000 – 45,000) – ($300 – $150) = $850 per contract.

- Maximum Damage:

- Maximum loss is limited to the net premium paid for placing the spread.

- In this example, it is $300 – $150 = $150 per contract.

- Break-even point:

- The break-even point is the lower of the strike price and the net premium paid.

- In this scenario, it’s 45,000 + ($300 – $150) = 45,150 points.

Profit & Loss

The maximum profit on a bull call spread is determined by subtracting the premium paid from the difference between the two strike prices. This occurs when the stock price crosses the high strike at expiration. On the other hand, if the stock trades below the lower strike price at expiration, the maximum loss equals the trade cost.

Formula for Max Profit:

- Test conditions:

Start by checking if the value of the underlying asset (St) is greater than or equal to the higher strike price (XH). - Spread Width Calculation:

If the condition is met, calculate the spread width by subtracting the low strike price (XL) from the high strike price (XH): (XH – XL). - Calculation of maximum profit:

Further, subtract the premium of the lower-strike call option (CL) from the premium of the higher-strike call option (CH): (CL – CH). - Final formula:

Combine the spread width and call option premium difference, and then subtract the result to get the maximum profit: (- (XH – XL) – (CL – CH)).

In summary, the given sequence outlines the steps to calculate the maximum profit for a bull call spread option strategy provided that the value of the underlying asset is greater than or equal to the higher strike price.

Formula for Max Loss:

- Start strategy:

Start by buying a call option with a low strike price (CL).

2. Concurrent Sale:

At the same time, sell a call option with a higher strike price (CH).

3. Maximum Loss Formula:

Calculate the maximum loss using the formula (CH – CL).

4. Risk Management:

Manage risk by combining these call options, creating a strategy that benefits from upward price movements while limiting potential losses.

[ Best App for Trading- Angel One]

Effect of Volatility on A Bull Call Spread

The effect of volatility on a bull call spread tends to be mitigated by simultaneously buying and selling call options on the same underlying asset with the same expiration date. The strategy’s near-zero implies that changes in volatility have minimal impact on the value of the spread.

As increases in the value of the long call option are usually offset by a corresponding increase in the value of the short call option. While not completely foolproof, the precise impact of volatility can vary based on various factors such as the option’s ‘on-the-money status’ and time remaining to expiration.

Time Decay

In a bull call spread strategy, time decay, or theta, affects the overall position differently for long call and short call options. A long call option suffers from time decay because its value decreases as the time to take a profitable action decreases. Conversely, short call options benefit from time decay, as the obligation to sell the option means the trader retains the full premium if it expires.

The net effect of decay during a bull call spread depends on the relationship of the stock price to the strike price. If the stock is near or below the strike of the long call, the value of the spread decreases over time. Conversely, if the stock is near or above the strike of the short call, the value of the spread increases over time. When the stock price is within the strike price, time decay has relatively little effect on the bull call spread.

Implementation

In a bull call spread, the trader expects a modest increase in the price of a selected asset within a certain time frame. It is executed by purchasing a call option with a strike price at or above the current market level and a specified expiration date. Simultaneously, the trader sells a call option at a higher strike price, sharing the same expiration date as the first call option. The overall cost of executing this strategy is determined by the net difference between the premium received from selling the call and the premium paid for buying the call.

Other Factors

Early Assignment Risk:

A short call option on a bull call spread faces early assignment risk, especially when it expires and if the price of the underlying asset exceeds the strike price of the short call. This may lead to an obligation to sell the underlying asset at the strike price.

Effect of dividends:

The initial assignment probability for short call options is affected by dividends. In-the-money calls, with shorter periods than dividends, are more likely to be allocated early.

Transaction Costs:

Costs associated with buying and selling options can accrue, especially in small amounts. These costs can affect traders’ profits or contribute to losses.

Market Conditions:

Bull call spreads are most effective in a moderately bullish market. High volatility or a bearish market may not be conducive to this strategy.

Expiration Date Choice:

The expiration date chosen significantly affects the success of a bull call spread. Too short a time frame may not allow the underlying asset to move as expected, while too distant expiration dates may result in higher option costs, requiring more capital for the strategy.

3 thoughts on “Bull Call Spread Option Strategy- For Beginners 2024”