Welcome to “insightstockology.com“. Within this blog, we are gonna discuss about “Long Call Option Strategy in Stock Market“.

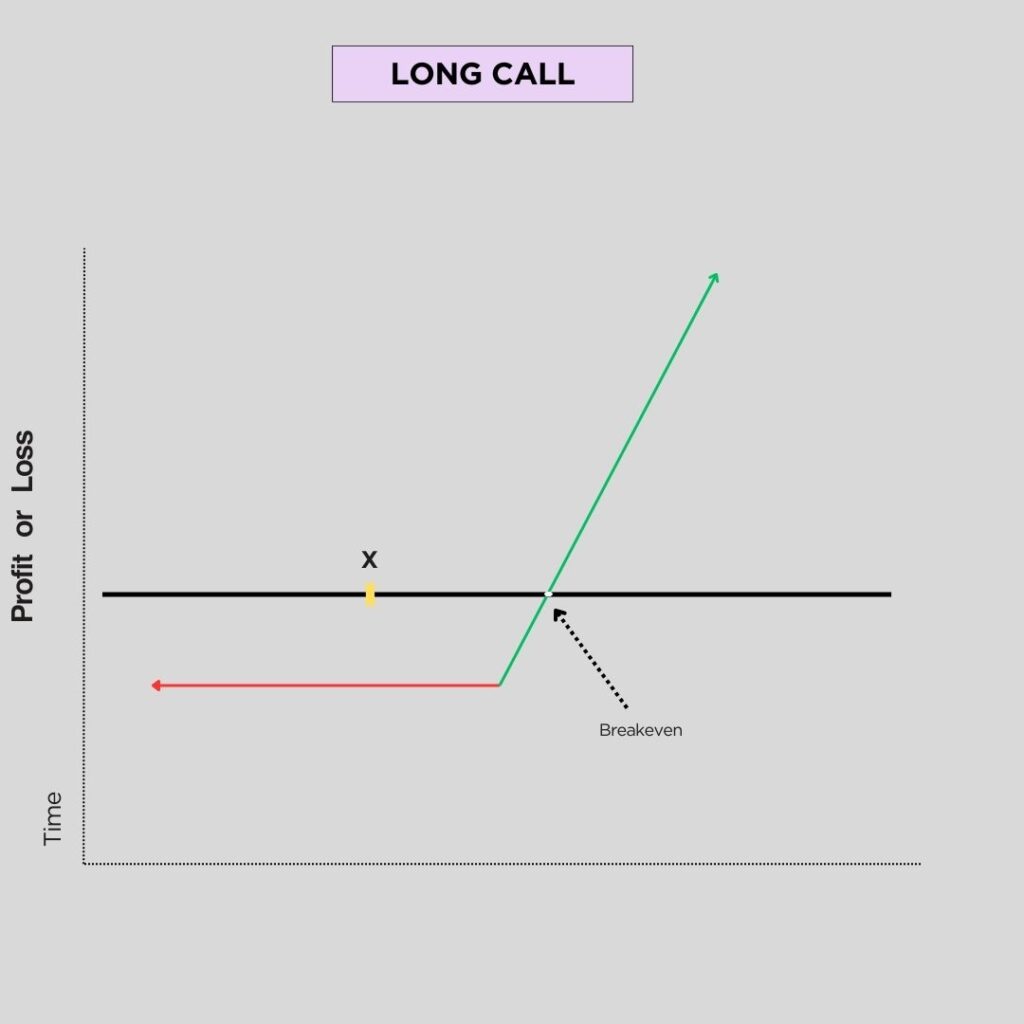

In the world of option trading, the opportunity to adopt a long-call option strategy is like holding the key to the door. This is because the long call strategy is adopt exactly when a stock holder realizes that the market will move from the current position. But to buy this right or the stock from the market, the stock holder has to pay a premium to the seller.

It’s like a dance trick, you pay a fee to the seller with the expectation of favorable market movement. The seller’s premium will protect you as a shield against your losses, if the market turn downwards. This allow you to remove all your shares from the market, limiting your losses to that initial premium.

Now let’s imagine as an example- A trader is optimistic that the market will give a bullish movement this time. It is a belief among them that the stock will climb higher before the expiration of the option contract. The trader invests in a call option in the hope that his investment premium will increase as the market rises. He can benefit from this. And if the trader’s market prediction turns out to be wrong and the market prediction turns out to be wrong and the market goes down, his loss will be still be limited to the premium paid to the seller.

In essence, a long call option is not just a financial maneuver; it’s a journey of belief, risk, and potential reward. It’s the embodiment of optimism in the ever-changing dynamics of the stock market, where the trader, armed with a call option, navigates the waves of uncertainty in pursuit of financial growth and success.

Contents:

Long Call Option Strategy In Stock Market Understanding

A long call is like betting on a stock that you believe will rise. It’s like saying, “I think this company is going to do great soon!” You pay a price (premium) for the chance to buy its shares at a specific price (strike price) in the future.

When you’re already feeling positive about a stock’s future, a long call be your companion. It’s not just about expecting stocks to rise; it’s more like saying, “I’m pretty sure this stock is going to soar!”

And the point here is that: the more confident you are about the big rise, the better. If you’re only expecting a small increase, there might be other, smarter moves.

Remember, the longer you wait, the less valuable your bet becomes. So, it’s not just about being right; it’s about being right at the right time. If the stock doesn’t perform as you hoped by a certain date, you might lose the money you paid for the bet (premium).

In simple words, a long call is your way of saying, “I believe in this stock, and I think it’s going places. Let’s see how it goes, and hopefully, I’ll make some money!” Just keep in mind, it’s not a guarantee, and sometimes stocks have their own plans, which might not always go our way.

Example OF Long Call Option Strategy

Suppose, you’re optimistic about the future prospects of XYZ Ltd, currently trading at Rs 1,000 per share. You decide to implement a long call strategy.

1.Buy Call Option:

You purchase a call option for Rs. 50 premium per share, with a strike price of Rs. 1050, giving you the right to buy XYZ Ltd. Share at Rs. 1050 each.

2.Investment Cost:

Each option contract typically represents 100 shares, the total cost of the premium for one contract would be Rs. 5,000 (Rs. 50 premium *100 shares).

3.Market Movement:

Over the next few weeks, you anticipate a positive market movement for XYZ Ltd.

4.Profit Scenario:

If the market price XYZ Ltd rises to Rs. 1200 per share by the option’s expiration date, you can exercise you right to buy shares at the agreed-upon Rs. 1050.

You can then sell this shares at the market price of Rs. 12000 making a profit of Rs. 150 per share (Rs. 1200 – Rs. 1050).

With 100 shares per contract, your total profit would be Rs. 15000 (Rs. 150*100)

5.Loss Scenario:

However, if the market price doesn’t rise above the strike price of Rs. 1050, and it remains below the break-even point (Rs. 1050 + Rs. 50 premium), you might choose not to exercise the option.

In this case, your maximum loss will be the initial premium paid, which is Rs. 5000 for one contract.

[Note: The long call strategy involves calculated risk with the potential for unlimited profit. It’s important to monitor market conditions and have a clear understanding of when to exercise the option or let it expire, depending on your market expectations.]

Nifty And Bank Nifty.

Suppose the current spot of Nifty is at 21,000 points, and Bank Nifty is at 45,000 points. You are bullish on the market and anticipate an upward movement in both Nifty and Bank Nifty over the next month.

- Nifty Long Call Option:

- Nifty Call Option Strike price: 21,000.

- Nifty Call Option Premium: INR 200 per contract.

- Expiry Date: 1 month from now.

You buy 1 Nifty Call Option contract, paying a premium of INR 200*1(1=50 lot size) = INR 10,000.

If the nifty7 rise to 21,500 by expiry, your call option would be in-the-money and you could sell it in the market. The profit would be (21,500-21,000)*50- INR 10,000(Initial premium).

If the Nifty price remains below 21,0000. Your maximum loss is limited to the premium paid(INR 10,000).

2.Bank Nifty Long Call Option:

- Bank Nifty Call Option Strick price- 45,000.

- Bank Nifty Call Option premium: INR 300 per contract

- Expiry Date: 1 month

You buy 1 bank Nifty Call Option contract, paying a premium of INR 300*1(1=15 lot size) = INR 4500.

If Bank Nifty rises to 45,500 by expiry date, your call option would be in-the-money, and you could sell it in the market. The profit would be (45,500-45,000)*15 – INR 4500 (premium).

If Bank Nifty remains below 45,000, your maximum loss is limited to the premium paid, INR 4500.

[If you want to implement your strategy, you may can use strategy builder software– Sensibull]

Conclusion

Finally this can be said, it’s not as simple as it sounds. If you don’t have any idea of stock market you will never earn money more than you will lose more. So, our opinion before start trading it is necessary to have complete knowledge about stock market.

2 thoughts on “Long Call Option Strategy In Stock Market- For Beginners 2024”